4.1 Overview of the 2030 Mediterranean power systems

All the results are presented for the Mediterranean countries perimeter, which corresponds to all Med-TSO members as well as Bosnia Herzegovina, Malta, and Syria, as shown in the block diagram below.

Figure 13. Mediterranean countries

The evolution of electricity consumption for 2030, between moderate trend growth and dynamic new uses of electricity

Table 6 shows the annual demand forecasts for all Mediterranean countries up to 2030 for the three scenarios. Given the massive impact of COVID-19 in 2020, the reference year for the electricity demand is 2019. The scope of electricity demand incorporates all uses of electricity (losses included), as well as new uses such as electric mobility. It includes the share of consumption satisfied by local production (for example self-produced electricity through solar panels on the roof in the residential sector). However, the electricity consumption of electrolyzers, which constitutes an energy transformation from electricity to hydrogen, is excluded from the scope of electricity demand.

Electricity Demand (TWh)

2020

2400

2680

2690

Demand increase

-

+19%

+33%

+34%

Compound annual growth rate (CAGR)

-

+1.8%

+2.9%

+2.9%

Table 6. Electricity demand forecast in 2030

The Inertial scenario shows an extension of historical growth reflected over the next decade, with

consumption reaching 2400 TWh by 2030, i.e., an increase of 19% compared to the reference year of 2019.

This corresponds to an average annual growth of +1.8%. In this scenario, the deployment of new and more

efficient electricity end-uses remains moderate.

In both the Proactive and Mediterranean Ambition scenarios, the demand growth is significantly higher, with

nearly 2700 TWh in 2030 (+33% vs 2019). This corresponds to an average annual growth of +2.9% in

electricity consumption over a decade, driven by favourable economic and demographic hypotheses, but

also with a much higher deployment of new uses of electricity, for example in mobility, and more generally,

an increase in the share of electricity in the overall energy consumption.

This global growth includes contrasting dynamics between Mediterranean countries

The evolution of electricity demand varies significantly among the Mediterranean countries, both when

looking at past trends and at the 2030 time-horizon, as illustrated below.

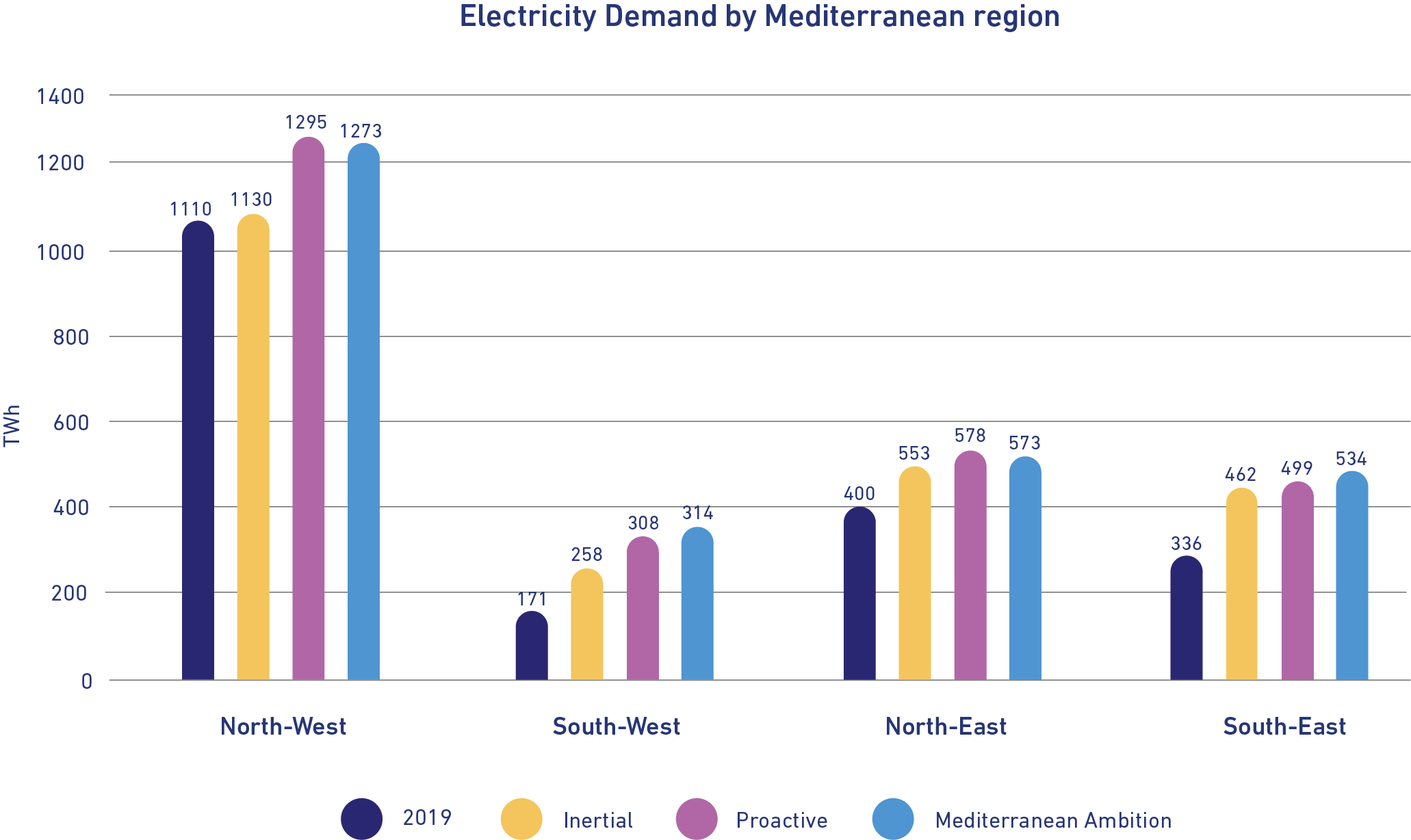

Figure 14. The electricity demand by Region and for the Mediterranean area in 2019 and for the three 2030 scenarios

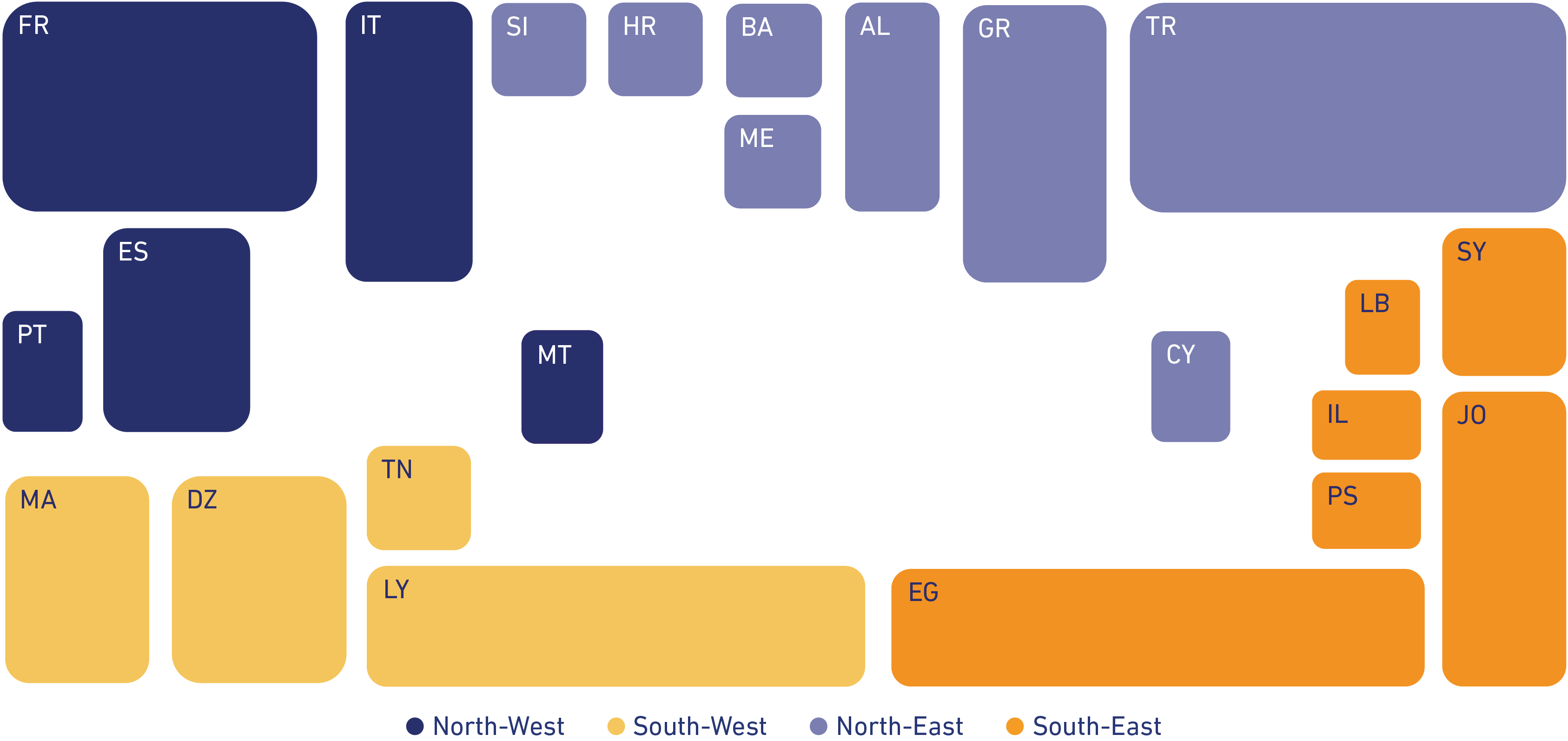

Where the distribution of Mediterranean countries in sub-regions is as follows:

Figure 15. Distribution of Mediterranean countries in sub-regions

For all the scenarios, the demand growth remains smaller in the countries of the North-West region

compared to the other countries, confirming the trend observed in the past decade. Consequently, the

electricity consumption of the countries located in the North-West of the region passes from 55% of overall

Mediterranean consumption in 2019 to around 47% by 2030 in the three scenarios. Focusing on the North-

West region, it must be noted that the growth observed in the two development scenarios (+17%) is much

higher than in the Inertial scenario, reflecting the positive electrification of energy consumption.

This difference between scenarios is less visible for the other regions, on the one hand due to the strong

correlation between macroeconomic and demographic projections and consumption and on the other,

because of the slow electrification anticipated in these areas.

Other complementarities among Mediterranean countries

While the evolution of annual electricity consumption among Mediterranean countries by 2030 provides an

initial indication of exchange opportunities, a more detailed investigation on a seasonal basis could provide

additional information.

The seasonal variability of electricity consumption is a direct consequence of the use of electricity for heating

in winter and for air conditioning in summer. Excessive consumption during these periods is therefore the

result of two combined elements: first, the general climatic conditions in a country and the temperature

range covered during the year; second, the development of heating and air conditioning equipment and

building construction techniques. Therefore, a colder climate does not necessarily imply an increase in

electricity consumption in winter, especially when the general heating fuel is natural gas. An accurate

modelling of those phenomena is not only important to assess the seasonal demand profile, but above all to

measure the effect of the strongest cold or hot waves that can strike any countries in exceptional moments.

This question is of prime importance for addressing the security of supply issue and sizing of peak generation

capacity.

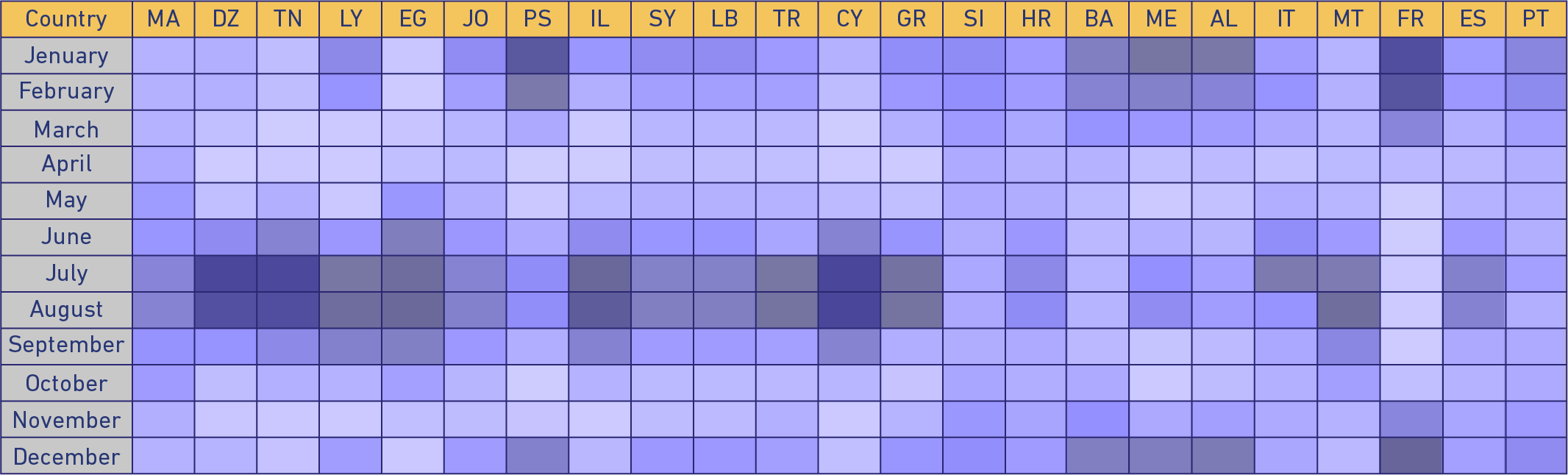

Figure 16 illustrates the seasonality of the demand (in the Inertial scenario) for each Mediterranean

country.

Figure 16. Hourly demand in the National Development scenarios for each Mediterranean country (the stronger the colour, the higher the demand)

In France, in several Balkan countries, and in Palestine, the peak load is observed during winter where the

demands for heating are higher and electric heating is well developed. On the contrary, the load during

summertime is higher in most of the North African countries (particularly in Algeria and Tunisia), in Cyprus

and Greece, but also in Italy and in Spain, as the demand for cooling is imperative and covers a large period

from June to August.

Development of generation capacity that responds to multiple challenges

In the context of growing demand for electricity, increasing the production capacity in specific countries is

essential to ensure or improve security of supply. Considering the presence of climate targets at the 2030

time-horizon, this results in a strong diversification of sources in favour of renewable energies, while fossil

production capacities show a slight decline.

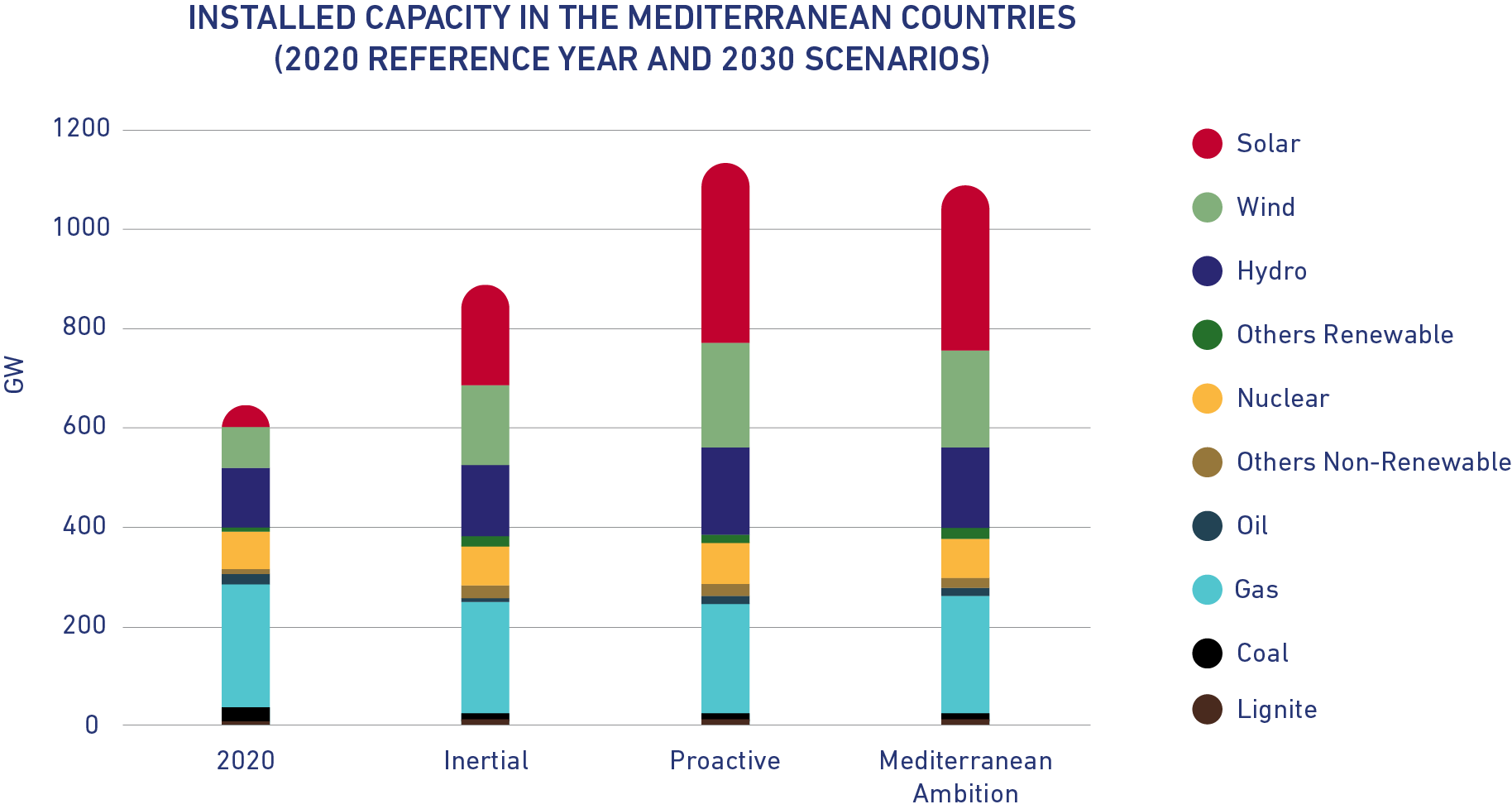

As shown in Figure 17, all three scenarios report a significant increase in the total installed generation

capacity, in the range of +36% to +71% compared to the installed capacity in the year 2020. The Proactive

Scenario results in the largest increase due to the high economic growth and the great ambitions for RES

development, while the installed capacity for Inertial scenario shows the most moderate increase.

Figure 17. Installed capacity in the Mediterranean countries

All three scenarios show a decrease of coal and lignite power plant capacity, in line with phase-out plans,

with an acceleration of shutdowns in several Mediterranean countries in South-Eastern Europe. The

generation capacity of gas-fired power plants remains generally constant, reflecting an overall reduction in

capacity in most European countries of the Mediterranean and a slight increase in the MENA countries, in

particular in the Mediterranean Ambition scenario.

The evolution of nuclear capacity is a constant global trend, even showing an increase (+11 GW) in the

Mediterranean Ambition scenario, where the capacity in Europe is maintained while a significant

development is noted in several MENA countries, such as Türkiye and Egypt.

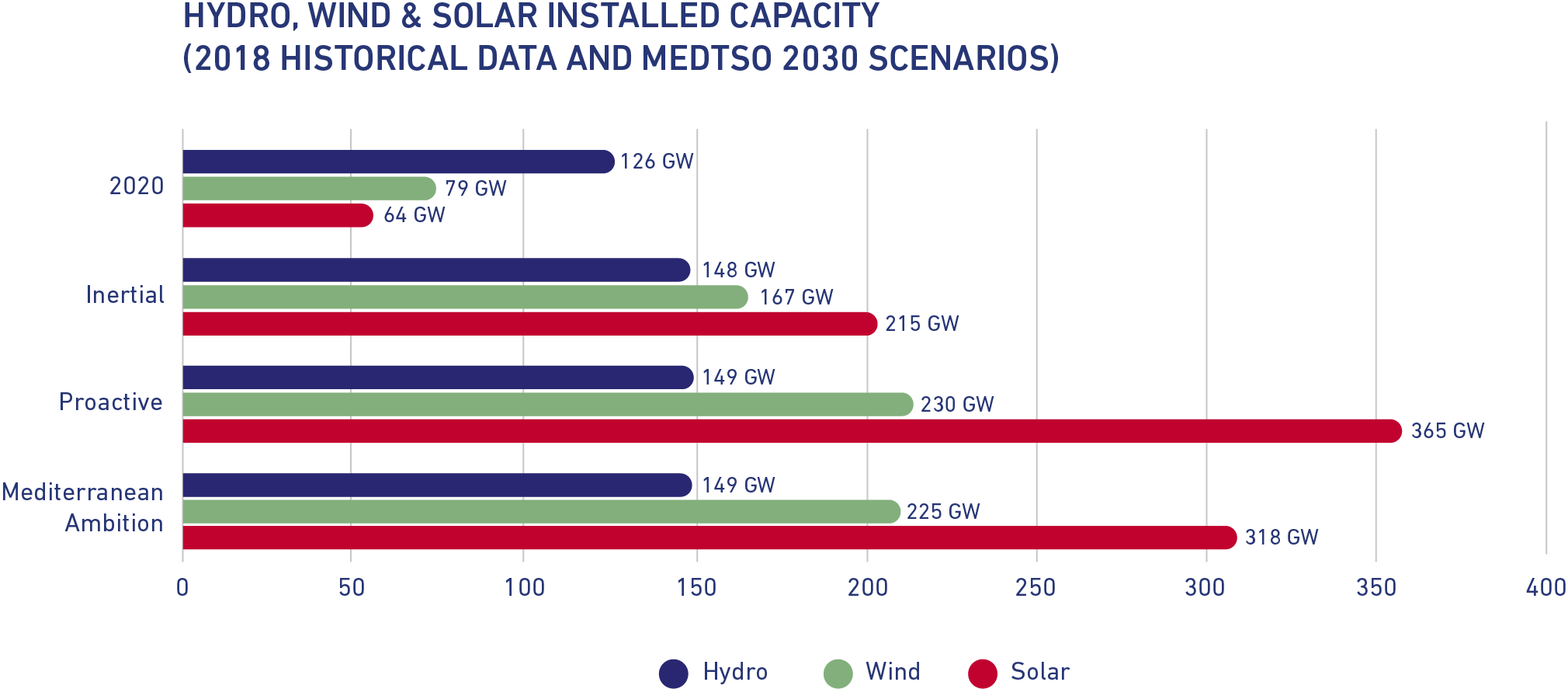

Figure 18 shows the remarkable development of solar and wind capacity in all Mediterranean countries.

Figure 18. Installed renewable capacity in 2020 for the three scenarios for the Mediterranean

The massive, rapid increase in solar capacity is expected to be mostly driven by a further cost decline to

produce PV modules, combined with the availability of natural resources. In the Proactive scenario, the

installed PV capacity is expected to reach 365 GW – more than five times the capacity in 2020.

New RES to meet the increase in electricity demand

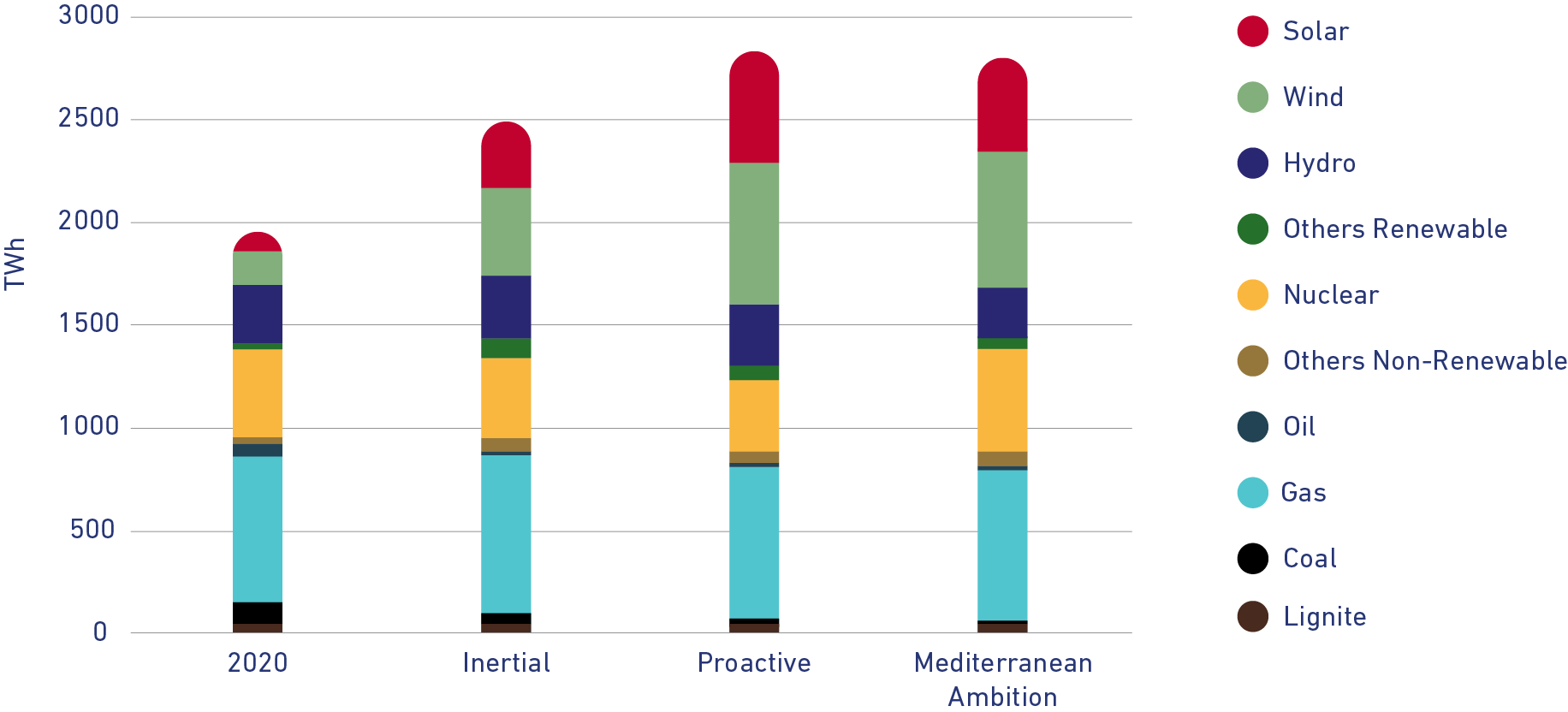

While electricity consumption is expected to increase from 19% to 34% by 2030 for the entire Mediterranean

region, this excess consumption is more than satisfied by the increase in generation from renewable sources,

as shown in Figure 19.

Figure 19. Electricity generation in 2020 and for the three scenarios for the Mediterranean

Fossil-fuelled generation does not increase in any of the three scenarios, and even shows an overall drop of

nearly 10% in the Mediterranean Ambition scenario. However, it should be noted that the sharp decline in

coal and lignite production, which fell by almost 50% in the Inertial scenario, accounts for only 2% of the

total generation in the Mediterranean Ambition scenario.

For the Inertial scenario, nearly half (46.6%) of the consumption is covered by renewable generation,

whereas this proportion was around 29% in 2020 (and 23% in 2015). Table 8 shows these percentages for

the three scenarios. Hydro generation is experiencing a modest increase in energy, but its overall share is

declining. At the same time, wind and solar production show a spectacular increase, jointly covering one

third (32% in then Inertial scenario) to 46% of demand, depending on the scenario.

Consumption covered by RES

29.0%

46.6%

58.9%

56.1%

From which Wind generation

8.8%

18.3%

24.8%

24.9%

From which Solar generation

4.4%

13.9%%

21.1%

18.3%

From which Hydro generation*

13.9%

11.3%

10.0%

10.0%

Table 7. Share of RES in generation in 2020 and for the three scenarios for Mediterranean

*renewable part

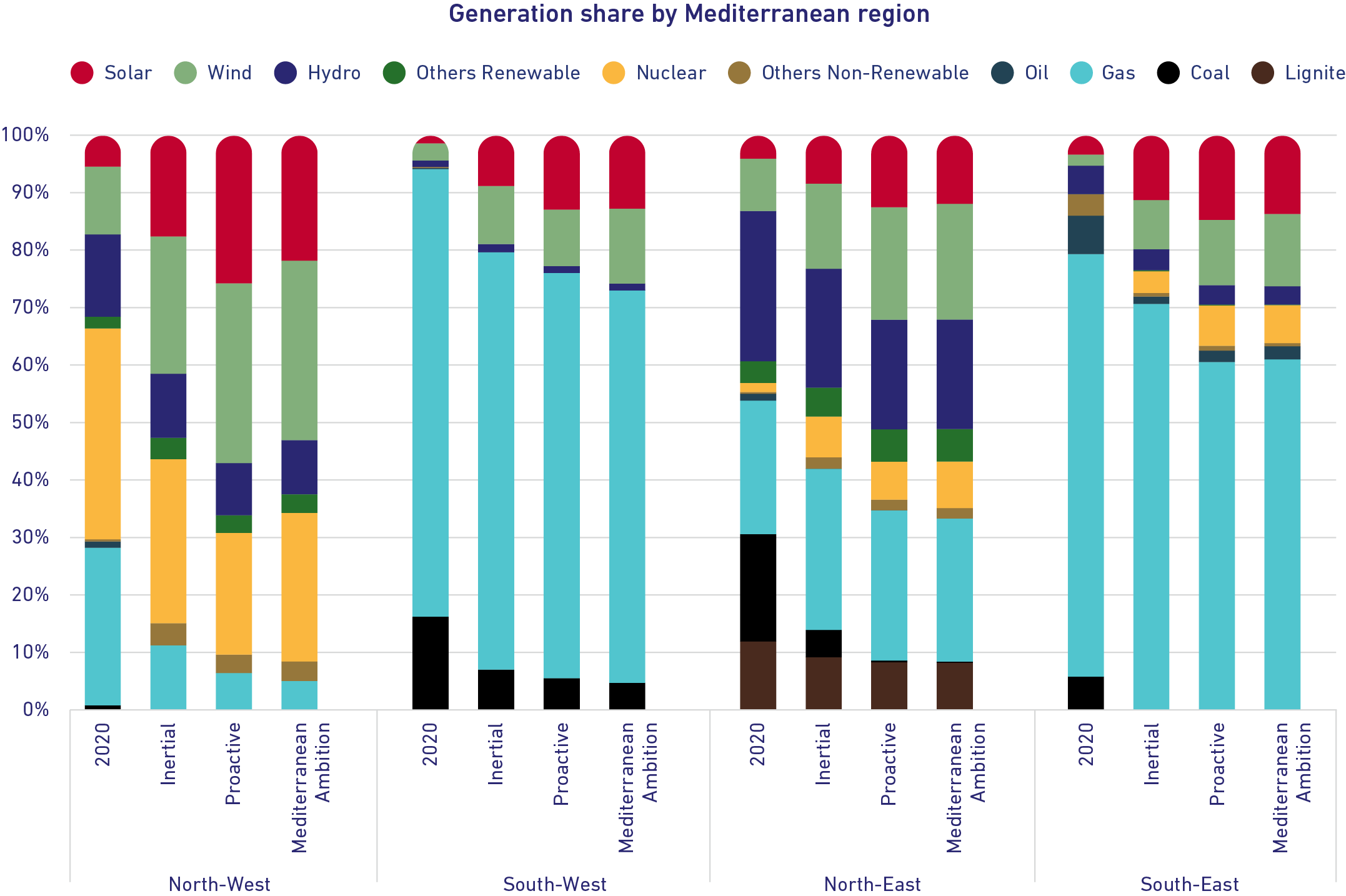

While the general trend of massive development of renewable energies is shared by all Mediterranean

countries, differences are notable when examining the evolution of the distribution of fuels between sub-

regions, as Figure 20 illustrates for the three scenarios (with 2020 as the reference year).

Figure 20. Generation share by region

Towards a carbon-free power system

For all Mediterranean countries, CO

2 emissions associated with electricity generation experience a reduction

of between 25% and 32% by 2030 compared to 2019 (the year 2020 isn’t taken as a reference due to the

impact of COVID-19), which corresponds to a decrease of at least 130 million tons per year.

Considering that in 2030 the increase in consumption is expected to range between 25% and 33%, the

decrease in emissions is the consequence of a strong reduction in the average CO

2 content of electricity

generation, from around 270 g CO

2 / kWh in 2019 to around 140 to 170 g CO

2 / kWh in 2030 depending on

the scenarios, as shown in Table 9.

Reduction of CO2 emissions (Mt)

(550)

-25%

-31%

-32%

CO2 content of electricity (gCO2/kWh)

274

173

142

140

Table 8. Expected variation in CO2 emissions in the Mediterranean

Contrasts in Mediterranean that create opportunities for electricity exchange

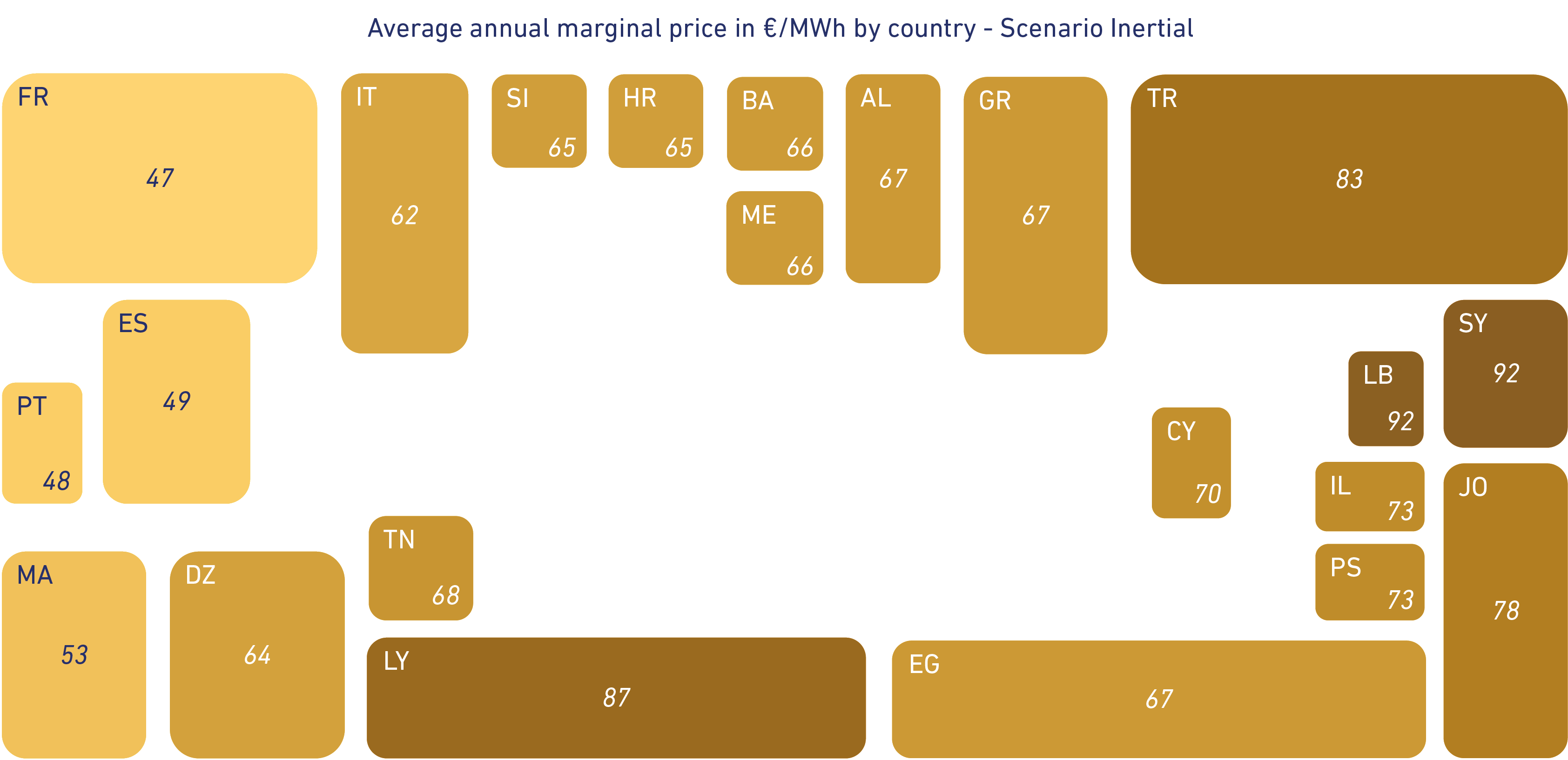

The average marginal price observed in the various Mediterranean countries can be taken as an interesting

indicator to assess exchange opportunities. On the one hand, it represents the competitiveness of the

national generation fleets to balance internal demand, on the other, it drives electricity exchanges between

countries as a consequence of economic optimizations.

Figure 21 presents the average marginal price by country for the Inertial scenario (unit is €/MWh).

As a result of the highest abundance of CO

2-free generation (renewable and nuclear), France, Portugal and

Spain show the lowest marginal price among Mediterranean countries (around €48 / MWh).

Conversely, in this scenario, Syria, Lebanon, and Libya show the highest marginal price (around 90 €/MWh)

in the region, which can be explained by a tight supply-demand balance and by a significant use of electricity

generation from oil.

Türkiye also shows one of the highest marginal prices (€83 /MWh), which results on the one hand from a

relatively inefficient thermal generation fleet and on the other, from a low import capacity which limits

opportunities on its Western border for importing electricity at lower price, while potentially experiencing

dynamic electricity demand growth.

Figure 21. Marginal price in the Mediterranean for the Inertial scenario

4.2 Presentation of the transmission projects

As anticipated earlier in this document, interconnection projects could be proposed for assessment as a

result of multiple drivers. Interconnectors can provide multiple benefits, such as improving market

efficiency and reducing cost for end-users, integrating more renewables, enhancing security of supply and

stability of power networks, etc.

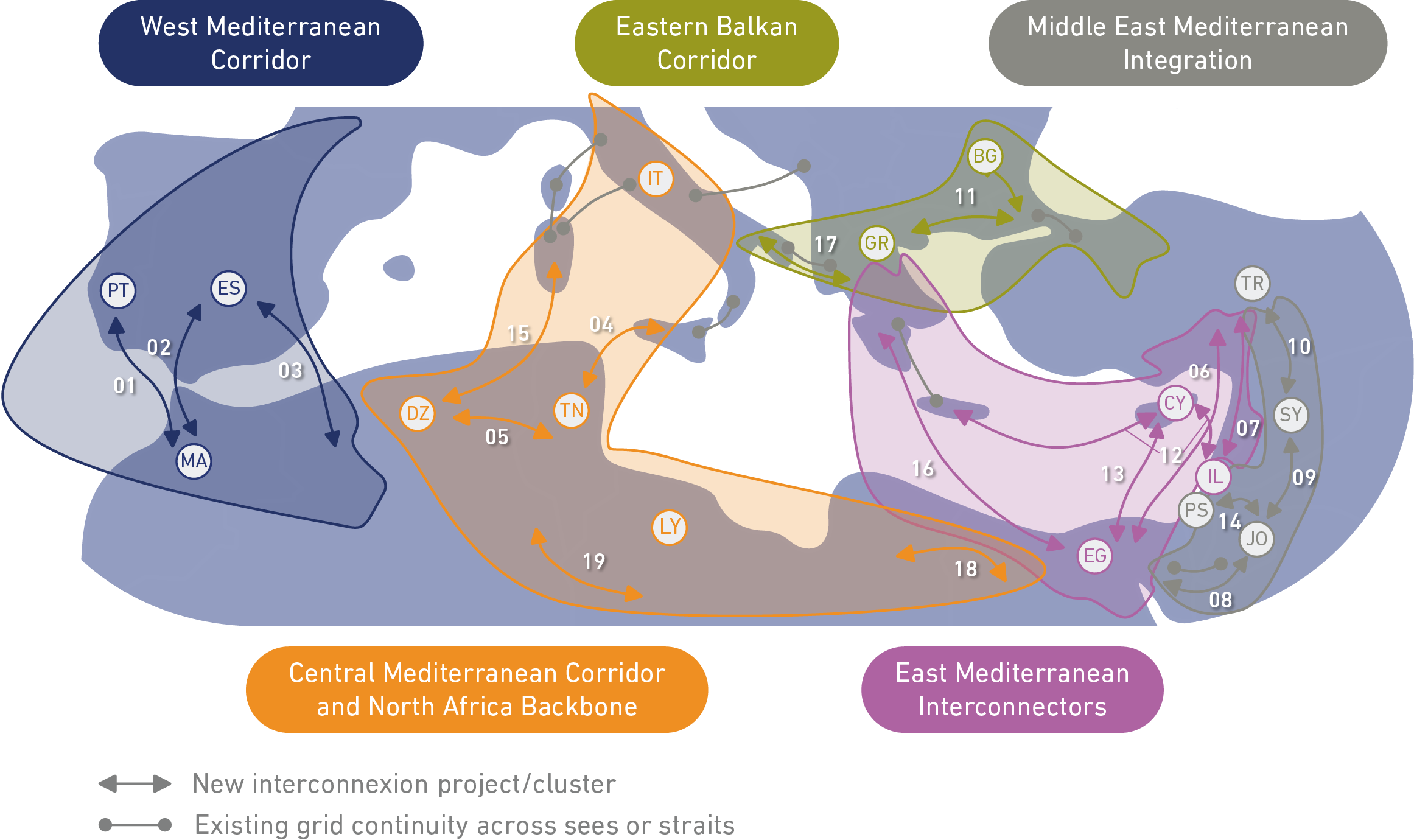

In this edition of the Masterplan, Med-TSO members proposed a total of 19 interconnection projects to be

assessed.

Figure 22. Corridors and regions to cluster assessed projects

Projects have been clustered into the following five corridors or regions (project clusters) to better reflect

common drivers and needs while also reflecting common geographic and network characteristics.

- West Mediterranean Corridor

- Central Mediterranean Corridor & North Africa Backbone

- East Mediterranean Interconnectors

- Middle East Mediterranean Integration

- Eastern Balkan Corridor

West Mediterranean Corridor

Project 1: Morocco - Portugal

Project 2: Spain - Morocco

Project 3: Algeria - Spain

1.1, 1.2, 2.1, 3.1, 3.2, 3.3, 3.4, 4.1, 4.2

1.1, 1.2, 2.1, 3.1, 3.4

1.1, 1.2, 2.1, 3.1, 3.3, 3.4

Central Mediterranean Corridor & North Africa Backbone

Project 4: Italy - Tunisia

Project 15: Algeria - Italy

Project 5: Algeria - Tunisia

Project 19: Algeria - Libya

Project 18: Egypt - Libya

+600

+1000

+750

+1000

+1000

1.1, 1.2, 1.3, 3.2, 3.3, 3.4, 4.1

1.1, 1.2, 3.2, 3.3

1.1, 1.2, 1.3, 2.1, 3.1, 3.2, 3.3, 3.4, 4.1, 4.2

N/A

1.1, 1.3, 2.1, 3.3, 3.4

East Mediterranean Interconnectors

Project 6: Egypt - Türkiye

Project 7: Israel - Türkiye

Project 12: Greece - Cyprus - Israel

Project 13: Cyprus - Egypt

Project 16: Egypt - Greece

+3000

+2000

+1000/+1000

+1000

+2000

1.1, 1.2, 3.1, 3.2, 3.3, 3.4, 4,1

1.1, 1.2, 3.1, 3.2, 3.3, 3.4

1.1, 1.2, 1.3, 2.1, 3.1, 3.2, 3.3, 3.4, 4.1, 4.2

1.1, 1.2, 1.3, 3.1, 3.2, 3.3, 3.4

1.1, 1.2, 1.3, 3.3, 3.4

Eastern Balkan Corridor

Project 11: Bulgaria - Türkiye - Greece

Project 17: Italy - Greece

1.1, 1.2, 2.1, 3.4

1.1, 1.2, 3.2, 3.2, 3.3, 3.4, 4.1

Middle East Mediterranean Integration

Project 9: Jordan - Syria

Project 10: Syria - Türkiye

Project 14: Jordan - Palestine

Project 8: Egypt - Jordan

1.1, 1.2, 1.3, 2.1, 3.2, 3.3, 3.4, 4.1

1.1, 1.3, 3.4

1.1, 1.2, 1.3, 2.1, 3.1, 3.3, 3.4, 4.1

1.1, 1.2, 1.3, 3.2, 3.3, 3.4, 4.1

Table 9. Projects groups and expected merits

Category

Symbol

Detailed Project Merits

Welfare, Sustainability and SoS

1.1. Reduce high price differentials between different market nodes/countries

1.2. Positively contribute to the reduction of RES curtailment and CO2 emission levels

1.3. Contribute to solving adequacy and security of supply issues

Isolation

2.1. Fully or partially contribute to resolving the isolation

of countries in terms of power system connectivity or to

meeting specific interconnection targets

Operation – Flexibility

3.1. Introduce additional system restoration mechanisms

3.2. Improve system flexibility and stability

3.3. Increase system voltage stability

3.4. Contribute to the integration of new RES generation capacity

Operation – Flows

4.1. Enable cross-border flows to overcome internal grid

congestion

4.2. Mitigate loop flows in bordering systems

The West Mediterranean Corridor

The West Mediterranean Corridor sees the assessments of three projects, involving Algeria, Morocco,

Portugal, and Spain. Such projects involve countries in a naturally well-defined geographical perimeter,

which jointly contribute to the further exploitation of the existing integration between the Iberian electricity

market and the Maghreb region. As a result, the expected benefits of these three projects are aligned, and

in all the three cases, we see a clear positive contribution in terms of:

-

Reducing the electricity price differential between the Iberian Market and the Maghreb countries

and benefitting from the lower prices observed in Portugal and Spain.

-

Increasing the integration of renewables, namely through the avoided curtailment in Portugal and

Spain that can be channelled to the Maghreb countries via the envisaged projects, leading to a

reduction in gas-fueled generation in Algeria and Morocco.

-

Meeting specific interconnection targets, which are quantitatively set in the case of the European

Countries.

-

Adding additional operational flexibility through the technical characteristics of the technologies at

use, namely those associated with VSC-HVDC technology, such as black-start capability and voltage

control.

Project n°1: Morocco - Portugal (MA-PT)

This project consists of a new interconnection between Morocco (Ben Harchane) and Portugal (Tavira) based on an HVDC link, with an envisaged capacity of 1000 MW and a total length of 325 km. This new link is expected to be based on a configuration of two circuits (bipolar converter) of 500 MW each. The project is promoted by the governments of both countries, who have jointly launched the elaboration of a feasibility study.

The Moroccan grid is currently interconnected with Spain through two submarine links, enabling Net Transfer Capacities of 900 MW from Spain to Morocco and 600 MW from Morocco to Spain. By 2030, a third cable is expected to be commissioned, increasing the transfer capacities to 1600 MW and 1300 MW respectively. Moreover, being part of the COMELEC grid, Morocco is interconnected to Algeria through two 400 kV transmission lines and two 220 kV transmission lines, enabling an estimated Net Transfer Capacity of 1000 MW.

Portugal is a member of ENTSO-E and part of the Continental Europe Synchronous Area. Presently, Portugal is interconnected with Spain, through six 400 kV transmission lines and three 220 kV transmission lines. This interconnection infrastructure leads to estimated Net Transfer Capacities of c.3300 MW and c.2600 MW, considering power flows from Portugal to Spain and from Spain to Portugal respectively. Considering the grid developments foreseen in coming years, the NTC values between Portugal and Spain are projected to reach 3500 MW (flow from Portugal to Spain) and 4200 MW (flow from Spain to Portugal) before 2030.

Project n°2: Spain - Morocco (ES-MA)

This project consists of a new interconnection between Morocco (Ben Harchane) and Spain (Puerto de la

Cruz). In addition to the two existing links, the project consists of a third link, based on HVAC technology,

which will increase the NTC between both countries by 650 MW from Spain to Morocco and 600 MW in the

other direction. The total length of the interconnection line is estimated at around 100 km, including a 30

km subsea cable.

This project is promoted by ONEE and REE and is included in the latest edition of the Spanish National

Development Plan. It is considered mature enough thanks to its short length and considering that the two

grids have been synchronized since 1997, when the first interconnection between Spain and Morocco

entered into operation. For this reason, the project is studied in line with a TOOT approach and is considered

in the reference grid for 2030.

Project n°3: Algeria - Spain (DZ-ES)

This project consists of a new interconnection between Algeria (Ain Fatah) and Spain (Carril) to be made

through an HVDC submarine cable. The HVDC interconnection will have a capacity of 1000 MW and a total

length of around 290 km. The maximum depth for the installation of the undersea cable will be around 2000

m.

The Spanish grid is currently interconnected to France, Portugal, and Morocco, with transfer capacities with

all neighbours expected to increase by 2030. The NTC between Spain and France is expected to reach 5000

MW (export and import). The transfer capacity between Spain and Portugal will reach around 4200 MW

(export) and 3500 MW (import) before 2030. The third interconnection cable between Spain and Morocco

will allow a total transfer capacity of 1550 MW (export) and 1200 MW (import).

On the other side, the Algerian grid is interconnected to Tunisia (250 MW in both directions) and Morocco

(1000 MW in both directions).

Central Mediterranean Corridor & North Africa Backbone

This group includes four interconnection projects strengthening Maghreb countries interconnections and

linking them to the Italian Network which presented a high integration rate of renewables in its energy mix

together with an overcapacity of the thermal power plants. Demand in Tunisia and Algeria is expected to

double within the coming ten years, while the Italian TSO is expecting a saturation of its demand and is

looking for new markets in order to optimize the renewable power flows to and from the islands of Sicily

and Sardinia.

From the other side, Libya is presenting one of highest Mediterranean marginal prices, which justifies any

new interconnection seeking to satisfy the Libyan demand with additional import from fossil-fuelled

generation in Algeria and well-developed renewables generation from both Italy and Tunisia. Preliminary

results of the current Masterplan have shown one of the highest numbers of saturation hours in the

interconnections linking Tunisia to Libya. For this reason, the North African Backbone project linking the

Algerian and Libyan systems through the Tunisian grid generated more benefits than the sum of the two

segments of the project (Tunisia – Algeria and Tunisia – Libya). This justified our theory and reinforced the

position of considering the Backbone as one project.

New interconnection also means greater flexibility and the ability to increase the share of renewables on

both coasts of the Mediterranean Sea. For this reason, this cluster is expected to reduce the total amount of

curtailed renewables. In addition, STEG is expecting that it will prevent the constant need for new

investments in power production units and provide access to a guaranteed electricity at a lower cost.

Project n°4: Italy - Tunisia (IT-TN)

The Tunisia-Italy interconnection will be the first link between these two countries, as well as in the central

corridor between the North and the South shores of the Mediterranean. This project, which is expected to

be completed by 2028, has been intensely promoted by Terna and STEG, with full support of the

governments of Italy, Tunisia, France, and Germany, together with the European Commission, which

included the interconnection in the list of Projects of Common Interest (PCI) and recently awarded Terna

and STEG a €307 M CEF grant to finance the project. The potential of this interconnection is considered to

be deeply strategic for both countries in terms of RES power flow optimization and grid operation, in order

to ensure security and adequacy standards.

Considering its maturity, the Tunisia – Italy project is already included in the reference grid considered for

the base case of Med-TSO studies. Consequently, this project has been analyzed with a TOOT methodology

in all Mediterranean Masterplans since 2015. It consists of a new HVDC link between Menzel Temime in the

Cap Bon region of Tunisia and Partanna in the south of Sicily. The converter stations will be VSC technology

on both sides with marine return. The maximum depth of the sea is not expected to exceed 850 m and the

voltage will be ±500 KV DC.

Project n°15: Algeria - Italy (DZ-IT)

There are presently no existing interconnections between Algeria and Italy. The Algeria grid is currently

interconnected with Morocco and Tunisia, while the Italian grid is currently interconnected with France,

Switzerland, Austria, Slovenia, Greece, and Montenegro. Italy is a member of ENTSO-E and part of the

Continental Europe Synchronous Area.

The project consists of a new interconnection between Algeria (Cheffia) and Italy (Cagliari Sud) through an

HVDC submarine cable. The HVDC interconnection will have a capacity of 1000 MW and a total length of

around 350 km. The maximum depth for the installation of the undersea cable is estimated to be over 2000

m. On the Algerian side, the connection of the HVDC Converter Station to the national grid will comprise two

50 km 400 kV AC overhead lines.

It is worth noting that this project is an explorative study proposed by Sonelgaz which is not currently related

to any official planning activity by the TSOs involved. In fact, this project is not included in either of the

respective National Development Plans by Sonelgaz and Terna.

Project n°5: Algeria - Tunisia (DZ-TN)

The first interconnection between Algeria and Tunisia was implemented in the 1950s and there are now five

interconnection lines between these two countries (two 90kV lines, one 150kV line, one 225kV line and one

400 kV line). Both electrical systems have been operated in synch with the Continental Europe one since

1997, following the commissioning of the Morocco – Spain interconnection. On the 2030 horizon, all 90 kV

and 150 kV lines will be decommissioned and the estimated total Net Transfer Capacity of the

interconnection between these countries is expected to decrease to 250 MW.

The new interconnection project between Algeria (Oglet Ouled Mahboub) and Tunisia (Kondar) will increase

the total expected NTC between the countries by an additional 750 MW. The project consists of a second

400 kV AC overhead line with a 1000 MW nominal capacity and total length of around 220 km.

Project n°18: Egypt - Libya (EG-LY)

Libya and Egypt have been electrically interconnected since May 1998 via a 167 km 220 kV, double circuit

AC overhead transmission line (OHTL). The 220 kV OHTL connects Al Saloum (Egypt) to Tobruk (Libya)

substations with an exchange capability of around 240 MW.

This project consists of a new 500 kV double circuit OHTL between Tobruk (Libya) and Saloum (Egypt) with a

total length of around 170 km. This could theoretically increase the interconnection capacity from the

current 240 MW to 2240 MW. However, the NTC used for the assessment of the project has been limited to

1000 MW for operational reasons.

Project n°19: Algeria - Libya (DZ-LY)

There is currently no existing interconnection between Algeria and Libya. The project consists of a new

interconnection between Algeria through the south of both countries through a 40 0kV OHL of 1000 MW capacity

and a length of around 520 km (500 km on the Algerian side, 20km on the Libyan side). Since the load concentration

in Libya is in the north (300 km further), other ways and connections points through the north will be investigated.

The East Mediterranean Interconnectors

This group includes five interconnection projects and connects countries belonging to the two shores of

the Eastern Mediterranean region, thus creating new electricity corridors in the region and providing

mutual benefits resulting from the complementary characteristics and energy prices of the countries

involved. More specifically, this cluster includes:

- Two interconnection projects linking the Turkish System to those of Egypt and Israel.

-

two interconnection projects linking the System of Cyprus to those of Egypt and Israel to the Greek

System.

- one interconnection project linking the Greek System to the Egyptian System.

The two most populated countries in the Eastern Mediterranean, Türkiye and Egypt, are experiencing

significant growth in their electricity consumption, which could reach up to 450 TWh and 300 TWh

respectively by 2030. Both projects connected to Türkiye show benefits linked to marginal price differences

between countries.

The system of Cyprus which is currently in autonomous operation is expected to be interconnected with

Greece, Israel, and Egypt through high-capacity HVDC interconnections of. This would bring benefits

associated with the security of supply issue, higher RES integration on the island and a reduction in fossil

fuel dependency.

Project n°6: Egypt - Türkiye (EG-TR)

At present there are no interconnections between Egypt and Türkiye. The Egyptian grid is currently

interconnected with the grids of Libya, Jordan, and Sudan. A new HVDC interconnection between Egypt and

Saudi Arabia is currently under construction and NTC between the two countries is expected to be 3000 MW

before 2030. The Turkish grid is interconnected synchronously with the grids of Greece, Bulgaria, and

asynchronously with Iran and Georgia via HVDC back-to-back links. Furthermore, there are interconnection

lines between Syria, Iraq, and Azerbaijan which are operated in an isolated region mode.

The project consists of a new interconnection between Türkiye (Adana) and Egypt (Port Said), to be

completed through an 800 km submarine 3000 MW HVDC link. It is worth noting that this project is not yet

included in the Egyptian National Plan. This document presents the explorative study of the project

performed by Med-TSO in the framework of the TEASIMED Project.

Project n°7: Israel - Türkiye (IL-TR)

The Turkish grid is interconnected synchronously with the grids of Greece and Bulgaria, and asynchronously

with Iran and Georgia via HVDC back-to-back links. There are also interconnection lines between Syria, Iraq,

Azerbaijan which are operated as isolated region mode.

The project consists of a new interconnection between Israel and Türkiye to be completed through 500 km

HVDC submarine cable. The new HVDC submarine link is expected to be implemented using VSC technology

considering the advantages over LCC. The project aims to increase the interconnection capacity between

Türkiye and Israel to 2000 MW and develop a new corridor in the Eastern Mediterranean.

Project n°12: Greece - Cyprus - Israel (GR-CY-IL)

Greece is strongly interconnected with Italy, Türkiye and its neighbouring Balkan countries with 1 DC and 6

AC interconnections: one with Türkiye, one with Bulgaria, two with North Macedonia, two with Albania and

one with Italy.

Cyprus is a member of the EU, but it is fully isolated from electricity or gas interconnections. Currently, RES

penetration on the island is limited due to its autonomous operation. An increase of RES penetration, in line

with ambitious EU targets, would severely affect the island’s security of supply.

The project consists of two new interconnections: one between Greece (Crete) and Cyprus, and one between

Cyprus and Israel, to be completed with HVDC submarine cables with a total length of around 1200 km

(approx. 314 km between Cyprus and Israel, 894 km between Cyprus and Crete). The HVDC link with a

capacity of 1000 MW should leverage VSC technology and allow for transmission of electricity in both

directions. Nevertheless, due to stability reasons the import/export capacity seen from Cyprus power system

is limited at 500 MW.

The project has entered its construction phase and has had access to EU co-financing. In particular, the first

segment (Greece – Cyprus) has secured €657 million of EU funding. For this reason, this project is considered

mature enough to be in the reference grid of the year 2030.

The main driver for the completion of the project is to end the Cyprus energy isolation. The interconnection

of the system of Cyprus is expected to unlock the integration of a high percentage of RES and promote

substantial RES development on the island, resulting in a subsequent reduction of CO

2 emissions and offering

significant economic and environmental benefits to the involved countries. Further to that, the project is

expected to create a new transfer route between Israel-Cyprus-Crete-Greece, providing mutual benefits in

the complementary characteristics and energy prices of the countries involved.

Project n°13: Cyprus - Egypt (CY-EG)

At present, the system of Cyprus is electrically isolated, while the Egyptian grid is interconnected with the

grids of Libya, Jordan, Sudan, and a new interconnection with Saudi Arabia will be underway by 2030.

This project consists of one new interconnection which includes two cables (2×500MW) to be constructed

from Egypt to Cyprus, with respective rating of DC to AC converters. The project will connect the Egyptian

grid to Cyprus at Kofinou substation. More precisely in the case of Cyprus, the international interconnection

cables 4×500M W for Crete and Israel and 2×500 MW from Egypt will end up on the Cyprus shore, in a single

point/single location. Two DC/AC converters that are rated 500 MW will allow inflow and outflow of energy

from and to the island. However, due to stability reasons, import and export capacity for Cyprus is limited to

500 MW.

Project n°16: Egypt – Greece (EG-GR)

The Egypt-Greece interconnection is studied as the first vertical corridor in the Eastern Mediterranean Sea.

The project consists of a bipolar HVDC interconnector with a capacity of 2000 MW and two AC/DC converter

stations located on the two sides: Traffiah in Egypt and Attica in Greece. The submarine route length is

preliminarily estimated to be about 843 km, with 20 km of DC underground cable lines on the Greek side.

Notably, the DC transmission lines on the Egyptian side, from the landing point to the converter station, are

not described and are not included.

Note: The Promoter’s project of the cross-border interconnection between Greece and Egypt, which is

supported by both TSOs, has a different technical description, although the process of including the project

of the Electrical Interconnection Greece – Egypt in the PCI list has commenced. Therefore, specific technical

and economic parameters (e.g., capacity, HVDC technology, voltage level, budget cost, etc.) of the

interconnection are under investigation in cooperation with the project promoter.

The Eastern Balkan Corridor

This corridor includes two interconnection projects: “Bulgaria – Türkiye – Greece” and “Italy – Greece”. The

first project aims to increase the existing NTC between Türkiye and the Continental Europe Synchronous

Area (CESA), which are already synchronously connected. This project increases the NTC between Türkiye

and Greece by about 600 MW and between Türkiye and Bulgaria about 700-1100 MW. The second project

aims to increase the existing NTC between Italy and Greece by an additional 500 MW. It connects the

Galatina (Italy) and Arachthos (Greece) substations with an HVDC submarine cable.

The increased interconnection capacity between Türkiye and CESA via the Bulgaria – Türkiye – Greece project

will enable transfer of the large amount of renewable energy from the Balkan region to Türkiye. It will result

in a reduction of thermal generation and CO

2 emissions in Türkiye. The Italy – Greece project will lead to

double interconnection capacity and increase reliability between Italy and Greece.

Project n°11: Bulgaria – Türkiye – Greece (BG-TR-GR)

In 2010, the Turkish power system was synchronized to the Continental Europe Synchronous Area (CESA),

with Greece and Bulgaria being part of the CESA to Türkiye transmission corridor. At present, there is one

interconnection between Greece and Bulgaria, one between Greece and Türkiye and two between Bulgaria

and Türkiye, with NTC values currently limited to 650 MW in CESA in the Türkiye direction and 500 MW in

the opposite direction. The second interconnection between Greece and Bulgaria and the related

strengthening of the 400 KV South-East Bulgaria, which is underway, are expected to contribute to the

increase of NTC to 1350 MW in the CESA to Türkiye direction and to 1250 MW in the opposite direction.

Currently Greece is strongly interconnected with 1 DC and 6 AC interconnections: besides the

interconnections with Türkiye and Bulgaria, Greece is interconnected with North Macedonia, Albania, and

Italy. The Turkish grid, besides the interconnections with Greece and Bulgaria, is currently interconnected

with the grids of Syria, Iraq, Iran, and Georgia.

The project consists of two new interconnections: one between Greece and Türkiye, and one between

Bulgaria and Türkiye, to be completed through AC overhead lines. Promoted by IPTO, TEIAS and ESO, it aims

to further increase the interconnection capacity between Türkiye and the CESA by about 1000 MW.

Project n°17: Italy – Greece (IT-GR)

The Southern area of Italy is characterized by a particularly saturated grid and demand by growing energy

transits in the presence of strong inputs of renewable production and by conventional generation groups

necessary for the correct functioning and stability of the electricity system. In order to achieve policy

targets, guarantee a safe operation of the network and increase markets and services efficiency, it will be

crucial in the coming years to increase the transport capacity of the Southern region through new

interconnections with foreign countries. Therefore, the presence of the current Italy-Greece HVDC

connection, already capable of accommodating a second connection, has led to the identification of the

doubling of the interconnection as an efficient development intervention (a further 500 MW for a total of

1000 MW in bipolar configuration). In this context, the existing HVDC connection between Italy and Greece

(LCC technology – 500 MW) has contributed to the safe management of the entire Southern area since

2001, thanks to the possibility of evacuating excess power towards Eastern Europe (Export) or of providing

adequate load coverage and reserve margins for the Southern area (Import).

The project consists of one new interconnection between Italy and Greece to be completed through HVDC

submarine cables. The project aims to further increase the interconnection capacity between Italy and

Greece by an additional 500 MW.

The project comprises of the following infrastructure:

- A new VSC HVDC Converter Station in Galatina (Italy)

- A new VSC HVDC Converter Station in Arachthos (Greece)

-

A new 400 kV HVDC submarine cable between Galatina (Italy) and Arachthos (Greece) of about 320

km in length.

The proposal assessed in this Masterplan involves the doubling of the existing interconnection (by an

additional 500 MW for a total of 1000 MW). However, assessments have been undertaken to verify the

feasibility of building the new connection in a 1000 MW bipolar configuration (rather than 500 MW) for a

total of 1500 MW, mapping project efficiencies and synergies and taking into account the useful life of the

existing connection.

Middle East Mediterranean Integration

This cluster includes four interconnection projects foreseeing new OHL for the reinforcement of the

connection of the countries of the Eastern Mediterranean region, with the aim of further increasing the

existing NTC between the involved countries.

The main merit of these projects is the Security of Supply improvement for the benefit of Syria and

Palestine, who should profit from increased import capacity from Türkiye and from Jordan.

Project n°8: Egypt – Jordan (EG-JO)

Jordan and Egypt have electrically interconnected since 1998 via a 13 km 400 kV, AC submarine cable (3 + 1

spare) submersed at a depth of 850 m across Taba to the Gulf of Aqaba with an exchange capability of 550

MW. Project 8 consists of a second interconnection between Jordan and Egypt to be completed through a

13 km 400 kV, AC submarine cable. It is expected to increase the current transfer capacity between the

two countries to reach 1100 MW, aiming to mitigate possible overloads in the path of the interconnection.

The Egyptian grid is currently interconnected with the grids of Libya, Jordan, and Sudan. A new HVDC

interconnection between Egypt-Saudi Arabia is currently underway and NTC between the two countries is

expected to reach 3000 MW before 2030. This new interconnection is part of the interconnected 400 kV

electric grid which is planned in the area, linking the GCC Interconnection Authority Grid (connecting the

grids of the six GCC countries at 400 kV) with the systems of Jordan and Egypt, with the aim of enhancing

system reliability, improving quality of supply and paving the way for the creation of an electrical energy

market in the Arab region. In addition to Egypt, the Jordanian grid is currently interconnected to Palestine,

Syria, and Iraq.

Project n°9: Jordan - Syria (JO-SY)

A first interconnection between Jordan and Syria was implemented in January 2001. The Jordanian and

Syrian grids are linked with one 400 kV single circuit transmission line of 154 km connecting the Der Ali

400/230 kV substation in Syria with the Amman North 400/132 kV substation in Jordan, with a designed

transmission capacity of 800 MW. In the current situation, this interconnection is out of operation.

The assessed project consists of one new interconnection between the two countries to be completed

through an AC overhead line. It is expected to increase the current transfer capacity between Jordan and

Syria of around an additional 1000 MW. This will mainly meet Syrian demand and also integrate more

renewable resources and base load units in the region.

Project n°10: Syria - Türkiye (SY-TR)

The project consists of one additional interconnection between Syria and Türkiye to be completed through

AC overhead lines. The project aims to further increase the interconnection capacity between the two

countries by about 600 MW.

The project comprises of the following infrastructure:

-

A new 400 kV AC overhead interconnection line of about 115 km between Birecik HPP in Türkiye and Syria

-

Upgrading of the B2B converter station on the Turkish side to 1200 MW (already featured in the

investment plan of TEIAS).

Project n°14: Jordan - Palestine (JO-PS)

In the present situation, the Palestinian territories (West Bank and Gaza) depend mainly on Israel for

electricity supply. The West Bank is also supplied through a 2x33 kV interconnection with Jordan to Jericho

on an isolated-grid basis.

The project consists of one new interconnection between Jordan and Palestine to be completed through an

AC 132 kV overhead line. It is expected to increase the transfer capacity from Jordan to Palestine by about

200 MW, aiming to feed power demand in Palestine on an isolated-grid basis.

The project is promoted by NEPCO and PETL.